- The receipt must include the data requested by the prevailing AFIP Resolutions (Argentine Federal Administration of Public Revenues). With CAI (Printing Authorization Code) / CAE (Electronic Authorization Code) prevailing at the date of issue.

- Issued to the company name and CUIT (Single Tax Identification Number) stated at the time of purchase order

- State Purchase Order Number(s)

- State Number(s) of entry sheet of materials / in-house proof of delivery / services or other certification / authorization granted to that effect.

- Invoice must be issued in the same currency as that on the purchase order note.

- Detail breakdown of VAT individual aliquots if applicable.

- In the case of payments due, detail concept / jurisdiction / aliquot / amount.

- Detail Province(s) of delivery of material or service rendering and associated amounts. In the case of transport services, state province of loading. This data shall be utilized for the correct determination of applicable deductions. In the case of not being able to state this data in the issued document, the latter shall be included in the body of the e-mail.

- For contracts in foreign currency, the exchange rate corresponding to the date prior to the issuance of the invoice and published by Banco Nación Exchange Selling Rate must me specified in the body of the invoice. Banco Nación offers two types of rates, Currency and Notes. In every case, without exceptions, the Currency column rate is to be selected.

- Documents issued with CAI must be submitted in the original format together with the prevailing validation of said CAI.

- Must not contain erasures or overwriting.

- In Electronic Credit Invoices, due date stated in the invoice and informed in AFIP must match the conditions stated in the purchase order.

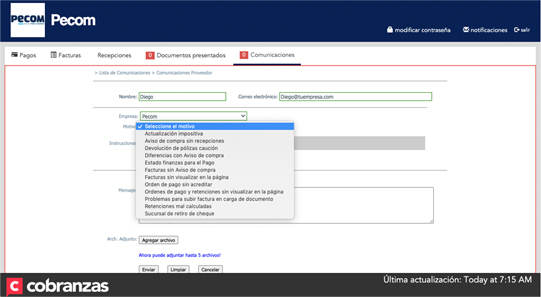

Invoices that do not comply with the above-mentioned requests shall not be accepted and will be returned to the issuer or a dismissal via e-mail or Cobranzas.com (electronic invoices) will be sent, or via postal mail if it was received in physical format.